The overwhelming news about the COVID 19 outbreak has been matched by rapid economic changes around the world. Many traditional banking industries are currently undergoing massive disruption. Meanwhile, FinTech startups are taking advantage and are swooping in to solidify their place in the arena of worldwide banking. There has been a legacy of loyalty displayed by generations of families who’ve trusted in the established financial sector. However, uncertain times like these have caused current investors’ trust in, and loyalty to, the legacy banking institutions to dwindle. Financial technology is gearing up to change the way the world banks.

Migrating to the FinTech Experience

In a 2017 study conducted by EY, the top FinTech adoption reflected in growing markets of China, India, the UK, Brazil, and Australia. According to the same study, 50% of consumers used FinTech for money transfer and payment services. 3 years ago the estimation for the market growth, in that study, was at a humble 65%.

FinTech, currently this transformative force during this pandemic, has two advantages.

- It thrives even in a remote working environment. As the world tries to limit offline contact, FinTech manages to soar.

- There is a massive increase in use during these inevitable lockdown practices in major countries.

Meanwhile, according to the deVere Group’s report, the isolation and lockdowns have seen a 72% rise in the use of FinTech apps in Europe in a week alone! With FinTech adoption numbers going through the roof, these pandemic survivors are key influencers of the way one visualizes, interacts, and makes financial decisions. During this wave of opportunity that FinTech is riding, their customers will expect a lot of help.

The Good, The Bad and The Ugly

Given the current scenario, there is some bad news and some good news in the market. One study points out that FinTech companies are likely to suffer as funding goes down. This will be due to the loss of pay, unemployment, pending bills, and the travel bans which hit the consumers hard during this pandemic.

This article points to some good news amidst such turbulent times. FinTech giants like Monzo and Tide are offering options such as alternative loan repayment plans and customer guidance services. Razorpay, an Indian FinTech company, and Featherlite, a furniture company, have partnered up to enable customers to rent office furniture to work from home. Similarly Paytm, an Indian FinTech unicorn and Reliance General Insurance, have partnered to deliver a COVID-19 insurance plan, which customers can quickly access and buy via the Paytm app.

However, in the latest report released, as of April 2020, by Capgemini in collaboration with Efma, has listed a couple of pain points even a booming FinTech market is facing:

- Only 21% of banks say their systems are agile enough for FinTech collaboration.

- More than 70% of FinTechs say they are frustrated with the bank process barriers.

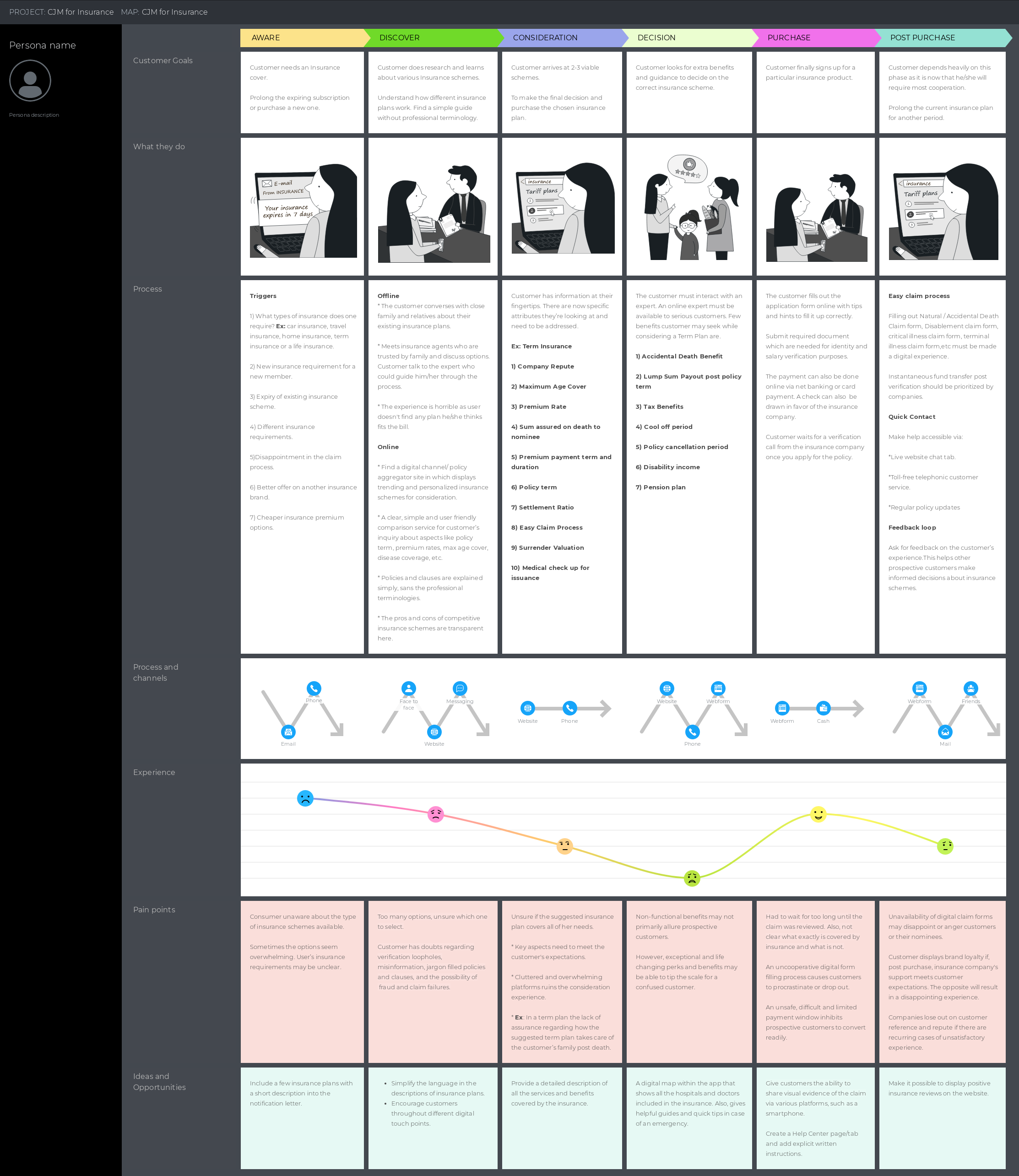

These developments have only pointed us to a singular direction. We’ve managed to decipher that the only way to create a lasting boom in the market is to help existing customers and attract potential users is efficient and improved customer journeys. This brings us to the importance of a customer journey.

Torchbearer in FinTech: Customer Journey

George Lucas, Founder, and CEO, Acorns Australia talked about the aim of FinTech product development; he said, “The best thing to do is to build a product that resonates clearly with people’s needs. Once you have that, your early adopters will recommend you to their friends and… you can quickly get viral growth through word of mouth.”

Every customer requires and needs hand-held experiences that guide them through the most complex of financial products, easily. Even if consumers are looking at high consideration products like bonds and insurance they should feel encouraged and enabled. Consumers are already hyper-aware and super sensitive about factors like customer service, interest rates, bank policies, and payout percentages. FinTech needs to step in and redirect them towards correct products and hand them tools to invest according to their goals. FinTech will now depend heavily on hygienic and easily navigable journeys. Let’s look at an example of a FinTech customer journey below.

View a bigger image.

7 Proven FinTech Design Principles

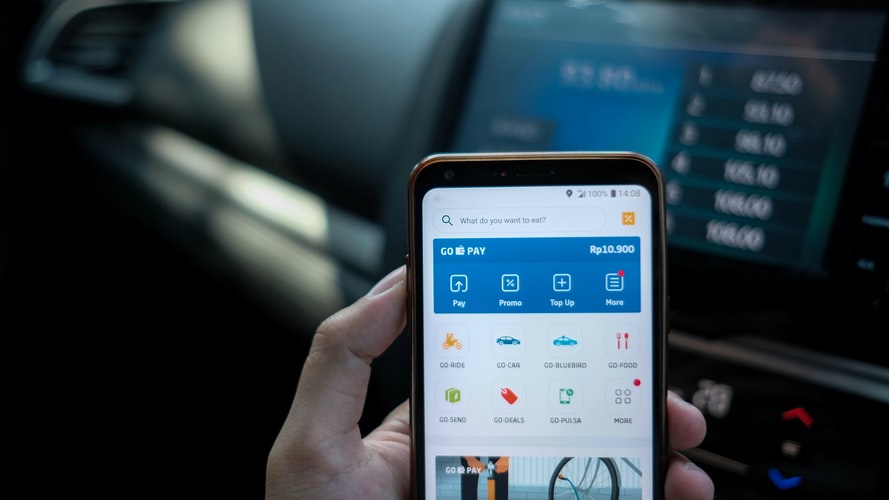

Good customer experience must help customers overcome awareness friction, consideration friction, and intent friction. According to a 2018 study conducted by Neilsen, for every potential insurance purchase, a mobile platform can increase the projected income opportunity by 70 billion dollars in India alone.

So as one can see, with assisted purchase journeys, especially on a mobile platform, customers can make high consideration purchases without too much procrastination.

1. Simplify complex data

It is imperative to simplify the complex information in palatable sized bites. This is because, in a financial scenario, prospective customers need to understand certain parameters and conditions which will help them in the long term. Simple data represented simply helps users consume, reflect, and decide what kind of products they may need to invest their hard-earned money into.

2. Avoid information clutter

Too much of anything is overwhelming. The same applies to information. No digital platform with too much information has ever been soothing to the eyes, let alone been anyway helpful to its users. Too much information has always led to confusion and increased dropout rates, something which we don’t want new or deciding customers.

3. Maintain transparency

In FinTech, pick out the most important and helpful information and provide it to the customers for their benefit. Since making the content simple not only benefits confused customers, the main trade of the game is to help a company earn their trust. To receive consumer loyalty is like saving a penny for the future, like familial references.

4. Prioritize user guidance

User guidance helps redirect customers in the right direction by filtering choices as per their requirements. It requires a lot of in-depth research of market knowledge into content the prospect is searching for. It requires designers to prioritize the users and ease of use to create a delightful experience journey.

5. Implement ease of accessibility

The ease of accessibility comes only with a good UI design. For example, something as simple as using gradients in a FinTech application to make it look appealing. The gradients also make the application look realistic. Similarly, sharp colors help maintain hierarchy amongst elements. Sharp colors also help navigate through spatial structuring. Fonts must be soothing and legible since fine print. In the case of FinTech, fonts are important because it helps with transaction proceedings.

6. Ensure a secure platform

Many companies have started improving FinTech app features with multi-layer security authentication for user’s safety. There are a variety of features that can be incorporated ranging from biometric authentication to face recognition. This kind of safety measure not only ensures trust amongst users but also enables a positive feedback loop for the product and its design.

7. AI-enabled financial assistant

The financial industry is heading towards a new future because it is readily incorporating artificial intelligence and predictive analytics. This will enable a higher focus on customer satisfaction and lower expenses on customer care. Artificial intelligence is being implemented in FinTech apps. This is because of its predictive analytical capability which enables it to help customers as a personalized financial assistant or advisor.

Moving Forward

The customer journey has become vital, but especially for financial high consideration purchases. They must be aware of the pros, and cons associated with such an investment. This helps to keep them around with proper post-purchase services. By using the design principles one gets an insight into an effective guided journey and how it looks like. Designers can focus on integrating useful attributes to simplify content and enable decision making. A properly structured FinTech customer journey will eventually help consumers stuck indoors.

Get in touch with our experts if you have further questions on customer journeys for Fintech products!